India’s crypto trading scene is rapidly evolving, and traders are constantly looking for platforms that simplify strategy building while offering powerful tools. Crypto trading platforms like Delta Exchange have emerged as prominent players in this space, particularly for those venturing into derivatives.

But is Delta Exchange the easiest platform for executing crypto trading strategies in the Indian market? In this article, we’ll examine Delta’s features, trading options, risk management tools, and overall user experience through a balanced review.

The Rise of Crypto Trading Strategies in India

Crypto trading, including options and futures, is gaining significant momentum among Indian traders. This growth is driven by the desire to move beyond straightforward spot trading and explore instruments that offer flexibility to hedge risks or speculate on price movements.

In 2024, India recorded over 90 million users, making it the global leader in crypto adoption. Reports suggest the Indian crypto market’s value is expected to rise substantially in the coming decade, which means more users need reliable, accessible platforms to navigate this dynamic space.

Traders of all skill levels, from beginners experimenting with basic crypto trading strategies to seasoned professionals exploring complex multi-leg options or algo trading, require interfaces that keep things clear without compromising on functionality.

This is where the choice of platform plays a crucial role.

Delta Exchange’s Trading Landscape

Delta Exchange for exploring various crypto trading strategies safely

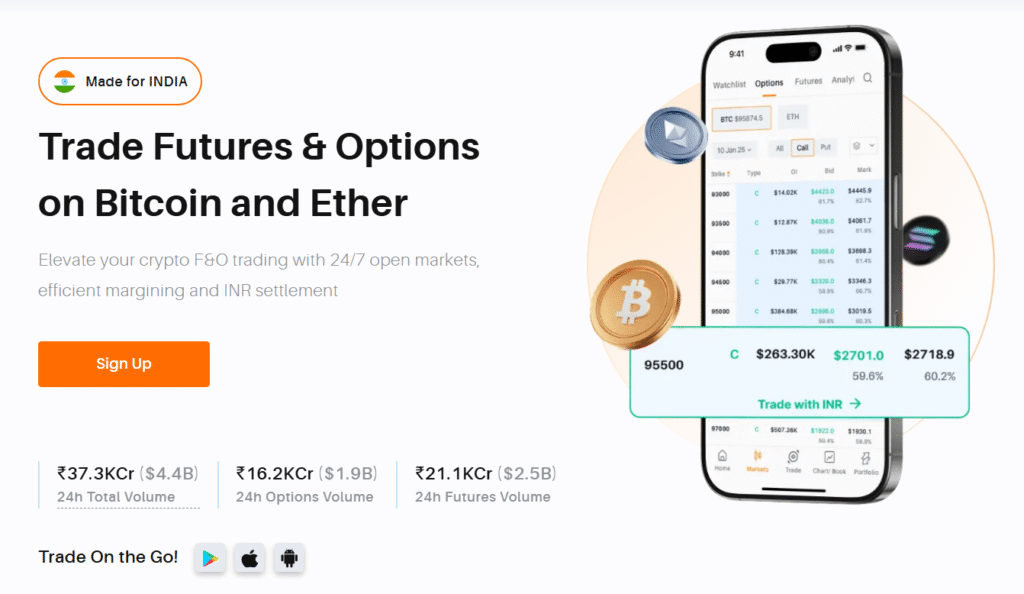

Delta Exchange has built a reputation since its inception in 2018 as a crypto derivatives platform that balances ease of use with advanced trading capabilities. Whether you want to trade Bitcoin (BTC), Ethereum (ETH), or over 50 other altcoins, it offers a suite of derivatives products such as futures, perpetual contracts, and European-style options designed for Indian traders.

What stands out is the platform’s direct support for Indian Rupees. This means Indian users can deposit and withdraw funds in INR without grappling with USD conversions or extra fees, a feature that significantly simplifies the trading experience and makes Delta accessible.

Making Crypto Derivatives Accessible for Newcomers

One of Delta’s key strengths is how it caters to traders new to crypto derivatives. The availability of a demo trading account lets users practice these strategies without risking real money, which builds confidence and reduces the barrier to entry.

Additionally, the platform supports small minimum trade sizes. This low capital requirement is great for retail traders wanting to explore derivatives without large upfront investments.

Check out this video to know the best trading strategy for beginners for crypto futures:

https://www.youtube.com/watch?v=UjNHWEHxAuU

Some Effective Crypto Trading Strategies to Try on Delta Exchange

Explore these popular crypto trading strategies to enhance your approach:

Covered Calls

This strategy entails holding BTC or ETH while selling a call option on the same asset. It is well-suited for bullish to neutral market conditions, enabling you to earn premium income while limiting the potential upside.

On Delta Exchange, covered calls serve as a balanced risk management tool, particularly when anticipating limited price movement.

Covered Puts

This approach involves shorting BTC or ETH and selling a put option on the identical asset. It fits bearish market scenarios, generating premium income and offering limited upside protection. Many traders use covered puts to boost income potential on short positions, making it a versatile choice for downtrending markets.

Bear Spread

This strategy applies puts to gain from moderate price declines in BTC or ETH options by purchasing a put at a higher strike and selling at a lower strike with the same expiration date.

This approach in crypto options trading manages downside risk with clearly defined risk and profit boundaries.

Iron Condor

The iron condor combines a bear call spread and a bull put spread on the same crypto asset with matching expiry dates. This strategy aims to profit from low volatility by collecting premiums from both spreads. On Delta Exchange, the iron condor is commonly used to generate steady returns in crypto options trading.

Bull Spread

This helps you benefit from modest price increases while limiting risk. It involves buying BTC or ETH options at a lower strike price and selling at a higher strike for calls; with puts, it follows the reverse pattern but retains a bullish outlook.

Robust Risk Management Features

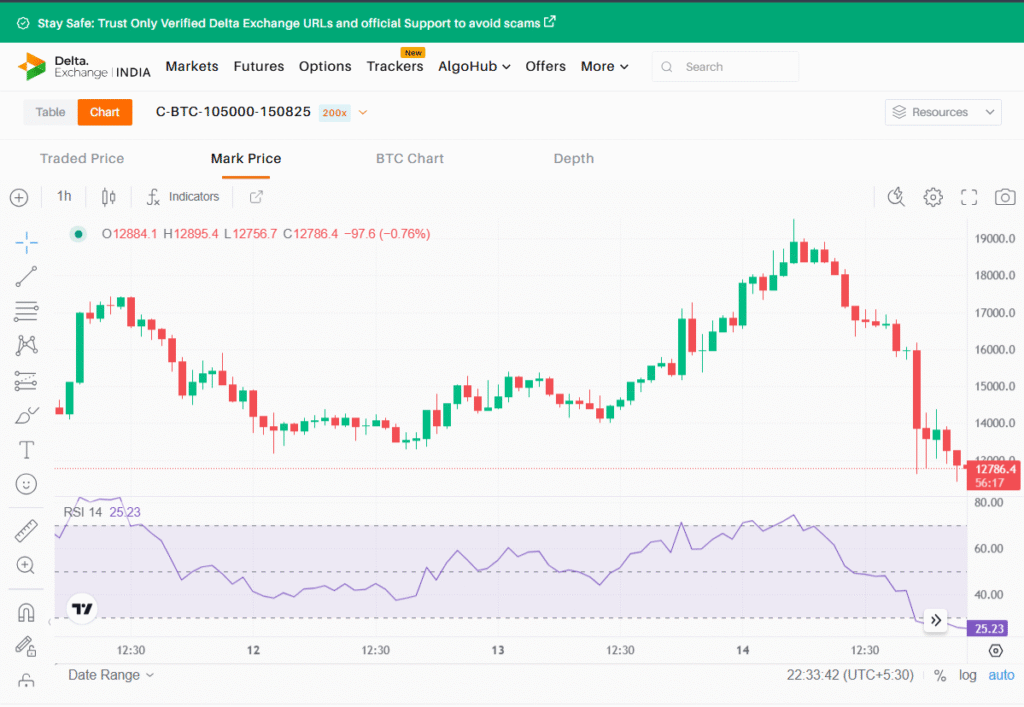

Try out crypto trading strategies effectively on Delta Exchange

Effectively managing risk can be the difference between success and setbacks in crypto trading strategies. Delta Exchange offers multiple ways to control downside exposure and protect capital:

- Stop-loss and take-profit orders: Automated exit points help limit losses and lock in gains.

- Demo account: Enables risk-free practice of complex strategies before live trading.

- Payoff charts: Visual tools to simulate trade outcomes, helping traders understand breakeven points and maximum profit or loss.

- Diversification: The cryptocurrency exchange platform encourages deploying various strategies rather than relying on singular approaches, which balances overall portfolio risk.

Is Delta the Easiest Platform for Crypto Trading Strategies in India?

Ease of use is often subjective, but several aspects make Delta Exchange stand out in the Indian crypto ecosystem:

- INR support: Eliminates currency conversion issues, simplifying deposits and withdrawals.

- User-friendly interface: Balances simplicity with powerful tools like the strategy builder and payoff visualization.

- Low entry threshold: Allows smaller investments to accommodate traders at various levels.

- Comprehensive support: Offers educational resources, customer support, and a growing community, giving traders guidance.

- Advanced features: Caters to experienced users with options for multi-leg strategies, automated trading, and market depth.

The Bottomline

In a market growing as fast as India’s crypto scene, having a platform that simplifies the complexity of derivatives trading while offering advanced capabilities is crucial. Delta Exchange’s emphasis on INR trading, variety of crypto derivatives, risk management tools, and beginner-friendly features make it a standout choice for Indian traders.

For anyone looking to explore crypto derivatives trading with an emphasis on ease and robust tools in the Indian market, Delta Exchange offers a well-balanced platform worth considering.

Want to explore crypto derivatives trading? Visit the website at www.delta.exchange or join their community on X.

Disclaimer: Crypto trading carries inherent risks due to its high volatility. Kindly do your own research before making any investment decisions.